Bank Lending, Yields and Real Values

By Alan Findlay

Every now and then it’s useful to take a step back from the daily grind of finding good investments and look at the larger trends developing in the world. The rise of non-establishment populism; the continuing next to nothing interest rates; the larger economic and social issues that seem to loom over our shoulders like the four horsemen of the apocalypse. One larger trend that strikes me as directly affecting the areas where cash-flow properties can be found is the relentless hunt for value by the big commercial banks and other providers of debt. A glaring market opportunity for that industry in the USA right now is the fact that most of the areas where I buy high yield real estate have very little bank debt. People tend to buy cash, and so prices are low and gross yields are still high. This is, of course attractive to buyers, but the fact that banks aren’t involved seems to be a glaring anomaly in a world where banks are keen to lend and can ‘create’ money at next to nothing. However one spin-off from almost zero interest rates is the fact that it allows banks to take more risk because margins are high. Banks traditionally haven’t lent in ‘investment’ areas, due primarily to high perceived risk. But what if banks found experienced players in these fields, and equipped them to buy large volumes of single and double family homes in these neighborhoods? The perceived risk would reduce, and large scale bank lending would percolate in. So what’s the upshot for us landlords, when large injections of bank lending flow into investment level areas? Firstly, and most obviously, it’s capital growth. But it can also lead to a range of connected positives. Higher values mean that it makes more economic sense to look after the houses (after all, banks appraise houses before lending on them). A better looking after the street attracts higher rents and better tenants. All in all, a win-win for the landlords. One large potential issue for cash flow hunters however, is that in the future, once bank debt permeates an area, landlords will increasingly need debt to make the numbers work, as gross yields will fall when bank debt moves in and prices rise – buying an apartment in Manhattan or Toronto for 2% Gross yield seems nuts unless a friendly bank is willing to step in. Once house prices are inflated from the real (cash) value by bank debt in every market across the US, then we’re looking at a very different animal from the current market- with mortgage debt, we must necessarily move our focus away from cash flow, to capital growth to make the investment work, which can make good returns, but gives control to the banks and away from landlords. I witnessed the exact situation in Hackney during the boom of the early 2000’s. In 1996, Hackney was rough – you could buy a 3-bedroom ex-council apartment for 80,000 Pounds Sterling. At rent of 1100 pounds a month Gross Yield was 16.5%. Good enough to buy as a cash investor, all things being said, even in a flat market. Fast-forward 20 years to 2017, and the same apartment, post gentrification, would cost 500,000 pounds, and the rent would have increased to 2200 a month. A five-fold increase in value, but only a doubling of rent. Is it still attractive to a cash buyer at 5.3% Gross yield? Not really, unless you’re taking a mortgage and buying for capital growth (I’d be a seller here). The cash flow part of the investment has totally left the equation – nothing more than an afterthought that might cover the mortgage. And therein, of course, lies the rub. Banks are looking at under-geared places like Buffalo right now, with an eye to lending. For existing landlords and soon to be landlords, the journey will be great, but when Starbucks opens, it’ll still be time to sell. Current state of the Buffalo market: record-high sales, record-low inventory June’s market data shows that Western New York’s housing market has overtaken the rest of New York in terms of price gains since 2000. Closed sales are up 15.4% statewide in the first half of 2016, and 34% up in the Buffalo-Niagara region.

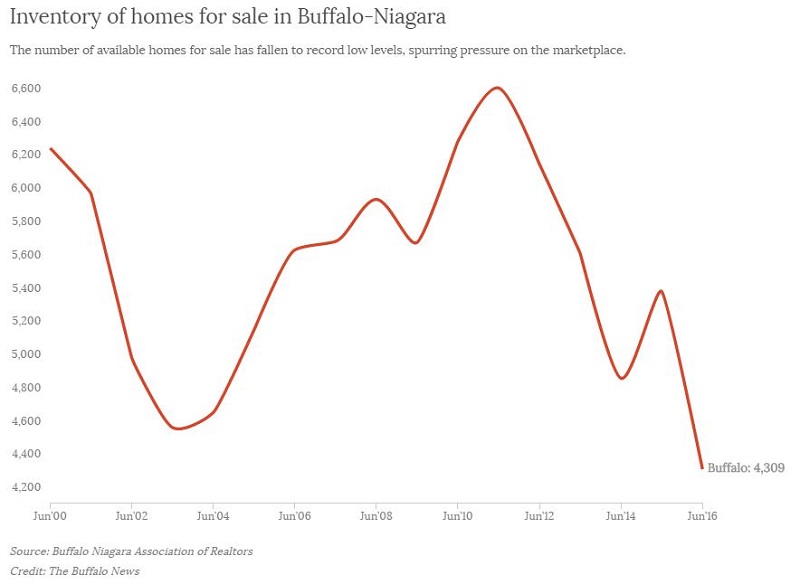

As a result of the sales surge, the inventory of listed homes fell 19.9% to 4,309 – the lowest level for June since 2000, although it’s a little higher than during the previous four months of this year.

And that’s despite adding 1,931 homes to that market – the most since the peak of last summer.

Get in Touch

-

Alan Findlay